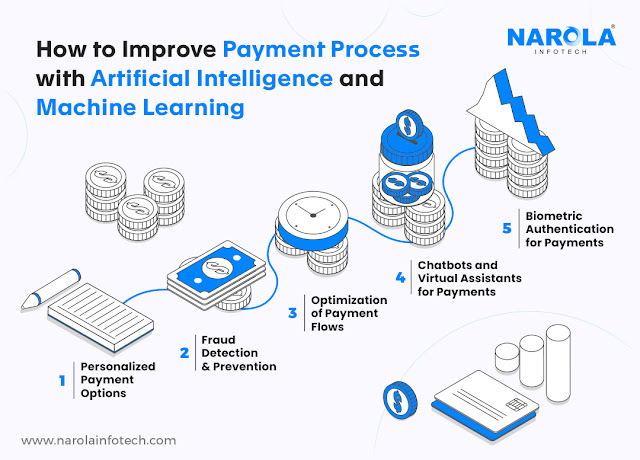

There are several use cases of AI and ML in payment processes. One of the most common use cases is fraud detection and prevention. AI and ML can analyze large amounts of data to identify patterns of fraudulent activity. This enables businesses to detect and prevent fraud before it occurs, which helps to protect customers and reduce financial losses.

Another use case of AI and ML in payment processes is the optimization of payment flows. By analysing data on payment transactions, businesses can identify inefficiencies in their processes and can make changes to improve them. This can result in cost savings for businesses and can improve the customer experience.

AI and ML can also be used to offer personalized payment options to customers. By analysing customer data, businesses can offer payment options that are tailored to individual preferences. This can result in improved customer experiences and can help businesses to build stronger relationships with their customers.

Chatbots

and virtual assistants are

another use case of AI and ML in payment processes. These technologies can be

used to provide customers with support and assistance throughout the payment

process. This can result in improved customer experiences and can help to

reduce the workload of customer support teams.

Comments

Post a Comment